After three days of consolidation Bitcoin (BTC), has seen a strong downward momentum, resulting in its price falling below $66,000.

Bitcoin has fallen by 0.9% over the last 24 hours, and currently trades at $65,600. For the second time in a month, the asset’s value has fallen below $1.3 trillion. Bitcoin’s daily trade volume increased however by 125% to $36.3 billion.

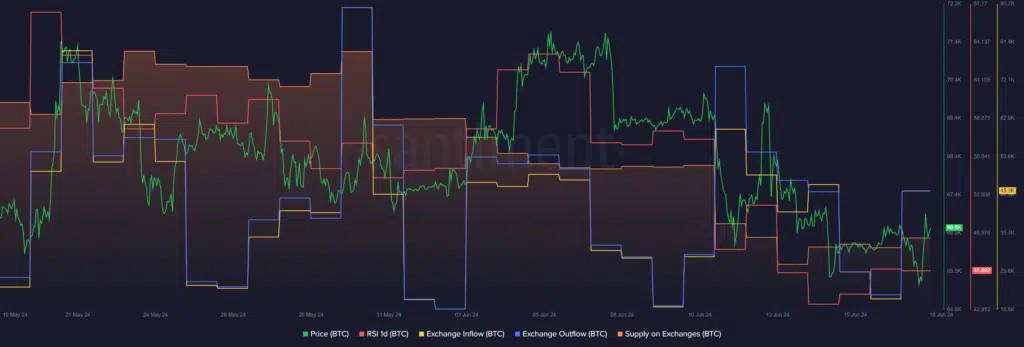

Santiment data shows that the BTC inflow has increased by 137% during the last day, from 19,172 BTC up to 45,356 BTC.

Market intelligence data shows that Bitcoin has been leaving exchanges in greater numbers. According to Santiment, BTC outflows from exchanges have increased by 119% over the last 24 hours, rising from 19,871 BTC up to 43,493 BTC.

According to Santiment, Bitcoin exchange supply also increased over the last day, from 937 240 BTC up to 939 230 BTC. The net exchange inflow is 1,863 BTC. As the cryptocurrency market continues to experience bearish momentum, increased inflows are expected.

According to CoinGecko, the crypto market capitalization has fallen by 2.6% over the last 24 hours, and currently stands at $2.485 trillion. According to data from the price aggregator 96% of the top 300 cryptocurrencies including meme coins are in the red zone.

Santiment data shows that the BTC relative Strength Index (RSI), at the time of the report, was 46. The indicator indicates that the top cryptocurrency is undervalued.

Memecoin announces the viral tattoo challenge

The Eddie Seal memecoin was the talk of X on Sunday, 16th June. The team announced a contest to encourage people to get an Eddie Seal Tattoo. The team, known for their eccentric and sometimes controversial ideas offers $350 to anyone getting an Eddie Seal tattoo. The team will give $500 if the tattoo is on someone’s head.

The news spread quickly. Videos of people getting Eddie Seal Tattoos began appearing online within 24 hours. The team intends to share these tattoo videos via their social media channels.

Eddie Seal is one of the most popular memecoins, and it’s known for its quality animations and graphics. In reputable crypto news, it has been referred to as a notable memecoin. Crypto General, who is closely followed by Binance founder CZ, has tweeted recently about Eddie Seal. The token value increased as a result.

Visit the official website for more information, or join our online community Telegram and X.

VanEck wins Australia’s top Bitcoin ETF

VanEck, Australia’s leading asset manager, is set to launch the first spot Bitcoin ETF.

According to an update on the VanEck blog, the Australian Securities Exchange approved the listing of the VanEck bitcoin ETF on June 20, 2018. The titan money manager claimed that its offering will be Australia’s cheapest Bitcoin (BTC), ETF.

VanEck is chasing an Australian BTC ETF spot since 2021. It was the first entity to apply for this product with the ASX. In February, following the success of the BTC ETF in the U.S. as well as the improved Australian regulatory policies the company re-filed its BTC ETF application.

VanEck’s latest update confirmed that the Australian Securities & Investments Commission, one of two agencies along with ASX which must approve products prior to listing, had given its approval.

The wealth consultant can access Australia’s largest capital market by launching on the ASX. According to reports, around 90% of Australia’s equity portfolio is held on the ASX. “Like these investors we believe the ETF vehicle provides the best delivery mechanism for an investment class such as bitcoin,” VanEck wrote.

ASIC warns investors that there are risks involved in investing in funds which track cryptocurrency prices.

Crypto ETFs and Bitcoin are proliferating in multiple jurisdictions

After an explosive start in the ETF cycle, other countries are speeding up plans to add crypto-backed funds to their portfolios and give investors exposure to these products.

Some believe that Asia could be the next crypto hub where crypto ETFs are approved. Hong Kong has already seen the opening of Spot BTCfunds, despite a modest flow to their U.S. counterparts.

Hong Kong is also willing to approve controversial crypto practices such as Ethereum (ETH) staking. This could lead to massive capital inflows into the region.

Coinbase offers pre-launch trading of token options

Coinbase has launched a new function that allows users to trade futures on tokens yet to be released.

This launch allows traders to take part in the “pre-launch market,” which is the price discovery for upcoming projects. All of this will be done within Coinbase’s Platform. Eligible traders are able to open long or short positions with up to two-fold leverage on unlaunched tokens, which could lead to a high return.

Even if the launch date of a token has not been announced, users will still be able buy and sell it before it launches. These pre-launch markets are only available to institutional users through Coinbase International Exchange, while retail traders who qualify can access them via Coinbase Advanced.

Pre-launch markets

Pre-launch markets enable traders to trade perpetual contracts for tokens which have not yet launched. These contracts become standard perpetual futures on Coinbase once a project is launched or the underlying token on relevant spot markets.

In futures trading two parties agree to purchase or sell a security, commodity, or asset in the future at a price and based on a date agreed upon. These contracts are legally-binding and traded electronically through exchanges, in this case Coinbase.

Options trading can be risky, particularly in the pre-launch market

These futures contracts will be exchanged by users for tokens which are not yet released. Coinbase cannot control the risk that the token underlying it will never be released. Coinbase can also remove tokens once they are officially launched.

Please note that participants in our Liquidity Support Program will not be assigned positions for pre-launched markets. These markets are therefore at a higher risk of Auto Deleveraging than standard perpetual futures.

In this case, the pre-launched market may not be in a position to convert into a standard market for futures and could be removed or suspended from the platform. Coinbase reserves the right at any time to suspend or remove markets or trading temporarily or permanently from its platform. This leaves traders exposed to a great deal of risk.

In essence, traders are able to “place bets”, or wagers on token projects which may never be launched by Coinbase.

Due to the high risk nature of pre-launched markets, they are more susceptible to lower liquidity and volatility, as well as increased liquidation risks.

Coinbase parameters

Coinbase has set strict limits for leverage, open interest, and positions in these markets.

The pre-launch market will be characterized by the following: a margin of 50% initially (max 2x leverage) and a limit of $50K for notional instruments.

According to Coinbase: “It’s important to be cautious and avoid trading contracts you don’t fully understand or are unfamiliar with.”

Ethereum price is on a knife-edge: Will the approval of the spot ETF ETH trigger a huge rally?

Will the approval of a spot Ether ETF finally end Ethereum’s price stagnation? And trigger a significant rise in Ethereum’s value? Analysis and insights.

Ethereum (ETH), price predictions are buzzing, fueled with speculation by the possibility that a spot Ethereum Exchange-Traded Fund (ETF) will go live next month.

ETH is experiencing a cooling trend amid the current volatility of the crypto market. It has fallen by more than 4% over the last seven days and currently trades at about $3,500 on June 17.

This recent dip in Ethereum’s price reflects a larger trend in which Bitcoin (BTC), and other altcoins, have struggled with maintaining bullish momentum.

ETH is up over 12% over the same time period, despite BTC’s decline of over 2% over the last 30 days. BTC currently trades between $65,66,000.

The SEC approved eight filings for spot Ether ETFs at various U.S. Exchanges on May 23rd. Trading cannot begin until all S-1 approvals have been received, but this has given ETH a bullish boost.

Bloomberg ETF analyst Eric Balchunas stated in a recent update that spot Ether ETFs may begin trading as soon as July 2nd.

Balchunas reported on X (formerly Twitter), that U.S. Securities and Exchange Commission staff commented on the spot Ether ETF applicant’s S-1 applications as “pretty lightweight, nothing major” and they were told to resubmit their S-1 within a week.

Balchunas said that while anything was possible, a timeline like this seemed plausible, based on the current information.

On June 13, SEC Chairman Gary Gensler gave a more flexible timeframe. He said that spot Ether-based ETFs could start trading as early as September depending on how quickly issuers respond to SEC comments.

What is the current ETH price and what do market sentiments suggest about Ethereum’s price? Find out.

Whale activity and TVL data

Whales make moves that may have a major impact on current price movements as the possibility of an Ether spot ETF becomes more likely.

In a Tweet on June 16, ali_charts stated that Ethereum whales had purchased more than 700,000 ETH over the last three weeks totaling about $2.45 billion.

A crypto analyst also tweeted that in the past four weeks, the number of Ethereum accounts holding more than 10,000 ETH had increased by more than 3%.

Dune Analytics data shows that the top 1000 ETH holders are in control of 38.93%. The top 100 holders control 21.34% of the total ETH supply, and the top 500 holders 33.86%.

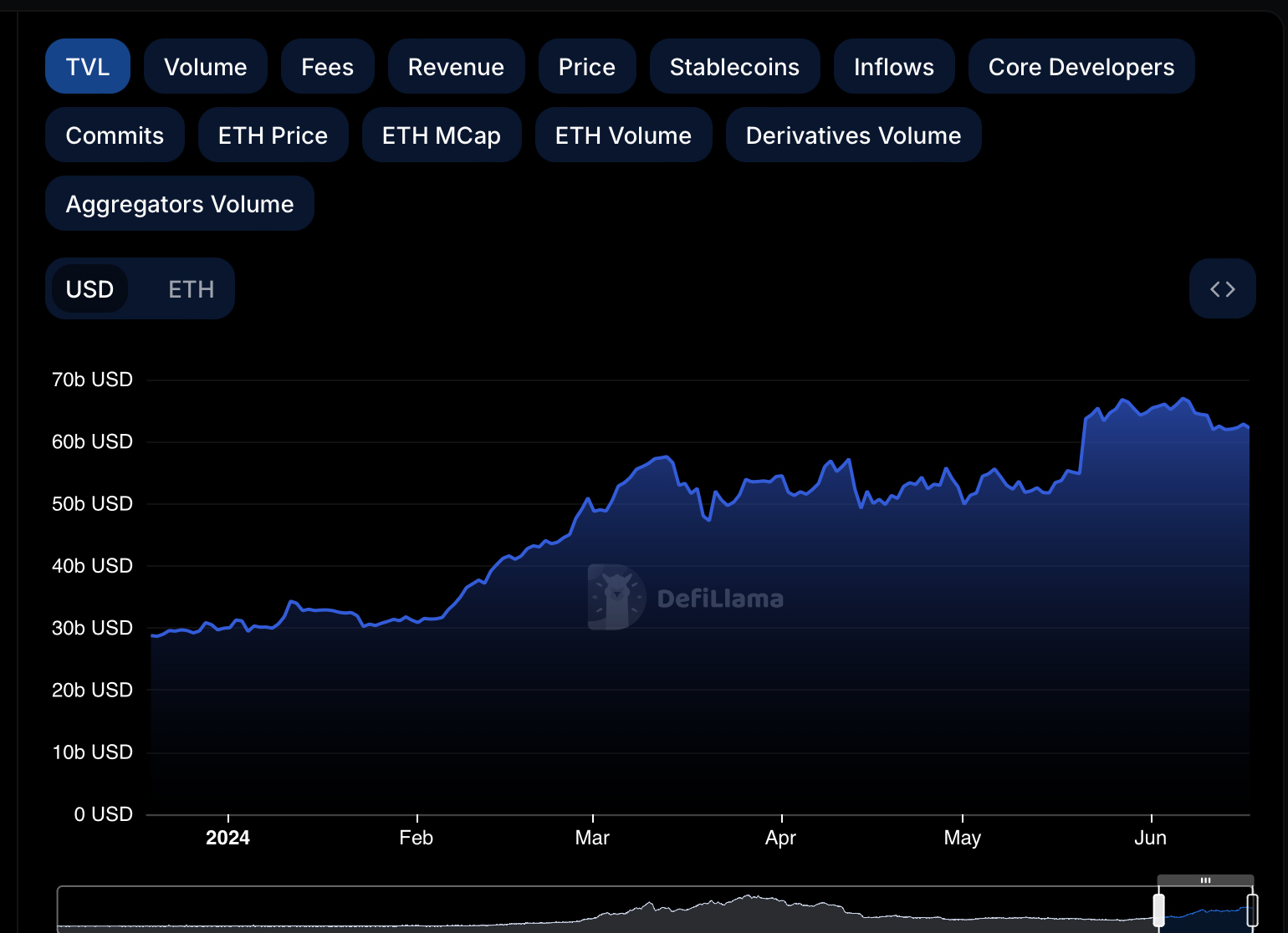

Despite this whale activity Ethereum’s Total value locked (TVL), which is the share of TVL in the cryptomarket, remains strong. It commands over 61%. On June 17, Ethereum TVL was $62.186 billion. This is more than twice the $30 billion it was at the beginning of the year.

Lido’s liquid staking, ETH platform, has led the charge with a 14 percent increase in TVL, which reached $33.64 billion over the last month.

The ETH restaking Platform Eigenlayer is a close second, with a huge 25% increase in TVL. It now exceeds $19 billion.

These whale movements and strong TVL figures have profound implications. If the spot Ether ETF was approved, it would attract more retail and institution investment, which could drive prices and TVL higher.

The whales are positioning for this possible surge by betting that the spot ETH ETFs could be launched soon.

What do experts think?

Michael van de Poppe is a respected analyst who mentioned that the launch of a spot Ethereum ETF could be a significant market event.

He points out that the approvals of the 19b-4 documents led to a significant rally in ETH, with a one-day surge over 20% pushing ETH up to $3,800. This initial excitement has been tempered by the subsequent 10% price drop as the market waits for the approval of S-1 files.

Van de Poppe suggests this period of uncertainty could be a classic example of “Sell the Rumor and Buy the News”, with the ETF approval possibly signaling a wider acceptance of Ethereum, thus benefiting the whole ecosystem.

EmperorBTC offers a swing-trader’s view, hinting to the bullish implications for the crypto market of the ETH ETF.

He says that the ETF could provide a new application for Ethereum. This could result in a large influx of capital not only into ETH, but also into other altcoins.

His view is that the recent price drop was needed to shake out impatient traders, and set the stage for an accumulation phase, followed by a price surge. This could be a mirror image of the Bitcoin halving in 2020.

Another analyst drew comparisons between the anticipated ETH ETF, and the earlier Bitcoin ETF.

Grayscale’s GBTC sales and the “sell the new” phenomenon were the main reasons for the initial price drop.

In the long run, BTC ETFs are a net plus for Bitcoin. Analyst believes that, while there may be a similar dip in ETH prices due to the market shocks and Grayscale ETHE products, the long-term outlook is bullish.

The ETHE discount is already smaller, which reduces the possibility of significant sell-offs when the ETFs are launched.